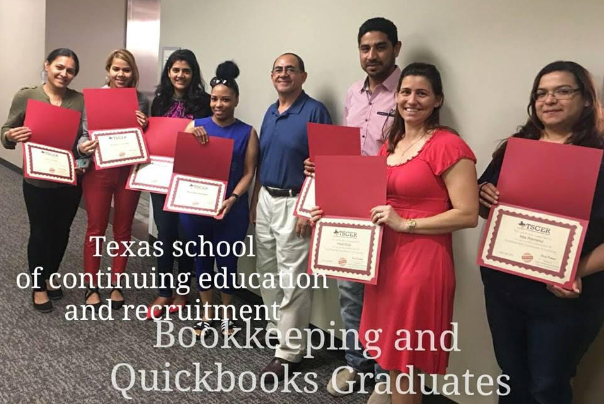

TSCER is a comprehensive training academy helping students acquire economically stable income through job or entrepreneurship placement. Our instructors assist students with industry specific training and certification, resume creation and review, interview preparation, and upon course completion, students’ resumes will be added to our list of TSCER alumni, which is shared with our recruiting partners.

Tuition assistance options are available. Schedule your FREE consultation with a TSCER representative to qualify. TSCER has campuses available in Dallas, San Antonio and Houston.

Most programs have flexible schedules to accommodate students currently working. Work can be completed on your time, including nights and weekends.

With most courses offered online, students are able to practice, study and participate all from the comfort of their home or other location.

Our virtual classroom allows students to access courses from anywhere and save valuable time. No more rushing out the door to get to class on time.

Specific courses allow students to get hands-on training with application, systems & tools they will use upon employment in their field of study.

At the conclusion of each course, students are allowed the opportunity to obtain specific accredited certifications most employers require.

Upon course completion, students are provided with resume editing, job search assistance, interview preparation and additional job placement support.

This course will provide in-depth, hands on training necessary for obtaining an accredited certification required by most employers for repair technicians

Read MoreIn this course, students will complete trainings to obtain positions in which they assist businesses in building budgets, identifying trends, and financial planning

Read MoreThis course is designed to assist students in obtaining an accredited admin certifications that will lead individuals to work in and assist IT departments

Read More

“One of the great needs in training these days is for one to one practical training in line with real industrial practices. With Texas School of Continuing Education & Recruitment the instructors you work with are Fortune 500 working consultants having renown experience from diverse industries. They have 1-5 model having no more than 5 students per class that gives you conducive environment to learn with hands on live training on servers whether its SAP, Quickbooks PRO, Cell Phone repair. They give so much pre and post mentorship to you that you really reach finishing line climbing success ladder.”

Omnis perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore